BBVA Bancomer’s business model is based on segmented distribution by customer type, with a philosophy of risk control and a long-term objective of growth and profitability. Like the Group, BBVA Bancomer works for a better future for people and offers its customers a mutually beneficial relationship, proactive service, advisory and comprehensive solutions.

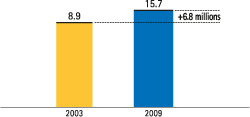

Against an unfavorable macroeconomic backdrop, the entity’s focus has been on strengthening its most valuable asset: its customer base. BBVA Bancomer has made great efforts to retain and secure the loyalty of its top valued customers through personalized service for preferred clients and the development of a specialized SME network to better service the SME segment. At year-end 2009, BBVA Bancomer had the largest customer base in the sector, totaling nearly 16 million customers.

Moreover, Bancomer has concentrated on:

- Protecting the net interest income.

- The change in the portfolio mix, with less consumer finance and credit card lending.

- Efficiency management through transformation plans.

- Strict control of risk quality in all of its phases: origination, monitoring and recovery.

The year 2010 will be one of transition for business growth; therefore, the Bank’s objective will be to take advantage of opportunities on the Mexican market, leveraging on its competitive advantages. Priorities will include:

- Fostering the growth of commercial activity.

- Maintaining its leadership position on the market in the principal business lines.

- Increasing loyalty in the extensive customer base.

- Containing cost growth without restricting investment in infrastructure and technology for expanding the business and continuing forward with the Transformation Plan to achieve greater productivity.

- Maintaining strict control of asset quality.

- Consolidating the leadership position in branding and strengthening the corporate reputation.