Integration of risks

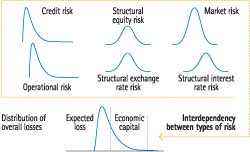

The Group’s economic capital is calculated by merging together the economic capital calculated for each of the risk types managed. The merging process is fundamental to integrating risks. A simple approach for merging the different types of risks would consist of calculating total capital as the sum of these individual capital figures. However, this method would ignore the fact that the risks are interrelated to a certain degree, with an effect of diversification that would, in the end, give rise to a total capital figure lower than the sum of the individual capital. The difference between these two metrics is the benefit of diversification.

The BBVA Group has developed a model for integrating the different kinds of risk in order to measure total economic capital more precisely. This model concentrates its efforts on capturing the relationships between the different risks (credit, market, structural and operational), in order to estimate the dependency structure and the impact of their relative size on the Entity’s overall profile.

According to this model, the distribution of total losses is constructed based on the individual losses, taking into account their interdependencies (measured as correlations among losses for each risk type). Once this distribution has been obtained, it is possible to calculate the global economic capital and the diversification factors to be applied to individual capital at a particular confidence level.

In this framework, sensitivity analyses are carried out on the diversification achieved under different correlation assumptions between the underlying risks. The diversification level of each of the risks depends greatly on the relative size of the risk against global risk, as well as the correlation among risks and the characteristics of individual loss distributions.

Overall risk profile

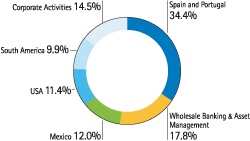

Attributable economic risk capital (ERC) consumption reached €22,135 million at December 31, 2009, a decrease of 1.1% compared with the same date the previous year (The growth rates presented are calculated against the close at the same time in December 2008 (€22,375 million), which includes the annual effects of recalibration and review of the models, as compared to the figure as of December 31, 2008 published in the 2008 Annual Report, of €21,541 million). The predominant risk type continued to be credit risk on portfolios originated in the Group branchnetwork from its own customer base, which accounted for 63.3% of the total. ERC from market operations was affected by more volatile market conditions, though its weight remained low, given the nature of BBVA’s business and its policy of minimal proprietary trading. The weight of the ERC associated with investments in associates went up due to the increased investment in CNCB. Conversely, ERC for operational risk increased 16% through the updating of economic models based on operational loss records in the Group over 2009.

In the area breakdown, Spain and Portugal reported ERC growth of 4.0%, primarily concentrated in the mortgage portfolios and SME, corporates and institutions portfolios. WB&AM went down 5.1%. In Mexico, ERC was down 4.6%, partially compensated by the appreciation of the peso. At a constant exchange rate, economic risk capital fell 6.1% as a result of the change in mix of the portfolios. ERC in the United States stood at €2,526 million, up 3.6% due to the incorporation of Guaranty, to reach a weight within the Group of 11.4% over the total ERC. ERC in South America rose 0.5%, largely due to increased lending throughout all of the countries. Lastly, the ERC for Corporate Activities was down 8.3%, in essence due to rises in market risk from increased hedges.

The Group’s recurrent risk-adjusted return on economic capital (RAROC), i.e., that generated from customer business and excluding one-offs, stood at 25.1%, and remained at high levels in all business areas.

Finally, the economic risk capital ratios stood at 8.7% for adjusted core capital and 14.0% for total capital, both figures above their respective benchmark (6%-7% and 12%, respectively).