Net fee income for the year fell 2.1% to €4,430m (up 1.0% at constant exchange rates). The trend is still influenced by fees and commissions income from mutual and pension funds, which fell 18.3% year-on-year, while fees and commissions income from bank services grew 4.3% during the year, despite reduced activity. Among these, the favorable trajectory of contingent liabilities and undrawn facilities (+18.0% year-on-year) which, despite the decrease of the volumes, increased due to proper management of their repricing. There is also evidence of a recovery of the fees and commissions for credit card related services, after the fall experienced in 2008. However, those associated with collection and payment services experienced reduction, due to the increasingly habitual use of online and telematic means and online banking, with lower fees and commissions, but that, in turn mean savings in Group costs. Those associated with securities (securities trading, assurance, issuance, administration and custody) also fell due to the decreased activity in stock markets. Within the framework of other fees and commissions, which have shown excellent behaviour this year, are those charged for syndicated loans, restructuring, advisory, insurance, distribution with third parties and waiver fees, among others.

Net trading income contributed €1,544 million in 2009, similarly to the previous year (€1,558 million).

Income from dividends stood at €443 million in 2009, as compared to the €447 million from the previous year. This item is largely made up of dividends from Telefónica.

The income by the equity method stood at €120 million for the year, after posting the fourth quarter contribution of China Citic Bank (CNCB), which is now considered to be one of the Group’s subsidiaries. It rose to €293 million in 2008, with those originating from the IBV Corporation for the sale of a share in Gamesa being especially noteworthy.

Finally, the item other operating income and expenses totaled €248 million in 2009, €218 million lower than the previous year. This was mainly due to a currency correction for hyperinflation in Venezuela (€245m) and higher contributions to deposit guarantee funds (up 28.8%) in the various countries where the Group operates. It included an extraordinary contribution to the Federal Deposit Insurance Corporation (FDIC) in the United States. The operating costs have not been compensated for due to the marked evolution of the earnings in insurance activity, which increased by 22.9% year-on-year to €720 million.

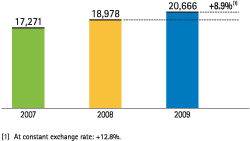

Based on the foregoing, the gross income for the year was €20,666 million, for an 8.9% increase over 2008 (12.8% at a constant exchange rate).