In 2009, the following trends in business activity and the Group’s balance sheet were maintained:

- There was a fall in the volume of lending due to the global economic slowdown during the year.

- Lending involving greater risk, such as consumer finance and credit cards, fell, while first home mortgages and loans to institutions increased.

- Customer funds increased thanks to a rise in assets under management in pension and mutual funds and to an increase in the lower cost funds (current and savings accounts).

- Customers’ preferences switched from time deposits to other products as a result of the sharp decline in interest rates in the Spanish market and BBVA’s excellent liquidity position.

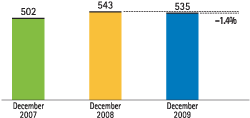

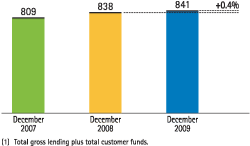

- Total assets and the Group’s volume of business remained stable. As of December 31, 2009, total assets amounted to €535 billion and business volume €841 billion. This compares with €543 billion (-1.4% year-on-year) and €838 billion (+0.4% yearon- year) respectively on December 31, 2008.

It should be noted that year-end exchange rates hardly had any impact on the year-on-year comparison of the balance sheet or on the Group’s business volumes. This is because the dollar’s depreciation against the euro (-3.4%) was offset by a rise in the Mexican peso (up 1.6%), the Chilean peso (up 21.3%) and the Colombian peso (up 6.3%), as well as other currencies.

As is normal, the main item on the asset side of the balance sheet is lending to customers, which represented 60.4% of total assets as of December 31, 2009, compared with 61.8% a year earlier. On the liabilities side are customer deposits, which maintained their part of the whole, at 47.5% of the total balance sheet at year-end 2009, compared with 47.0% in December 31, 2008. Thus the proportion of loan-to-deposit ratio stood at 1.27 (1.31 in December 2008). Including marketable securities and subordinated liabilities, the total weight of customer funds on the balance sheet was 69.5% of liabilities (69.4% in 2008).