We closed 2009 as a 'better bank'

Sound operating result

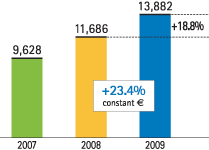

- Net interest income

(Million euros) -

- A strong net interest income through a proper price management and improved funding mix

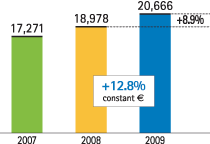

- Gross income

(Million euros) -

- Good performance of gross income

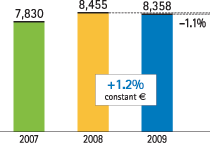

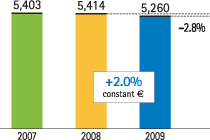

- Operating costs

(Million euros) -

- Strict cost control

- Total income/costs

Accrued earnings (base 100 = 2007) -

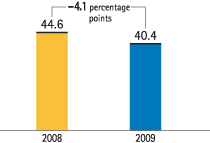

- Efficiency ratio

(Percentage) -

Resulting in overall improved efficiency

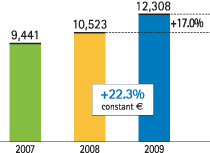

- Operating income

(Million euros) -

- And an extremely dynamic operating income

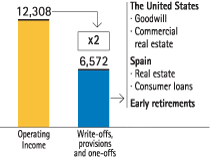

This allows a major effort to be made in provisioning

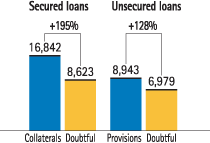

A high level of coverage for doubtful assets with provisions and collaterals

Recurrent earnings in a much more complex environment

- Operating income and provisions

(Million euros and number of times) -

- Coverage including provisions and collaterals(Million euros)

-

- Group net attributable profit excluding one-offs(Million euros)

-

That result in closing 2009 better capitalized

And obtain an above-average total return for the shareholder

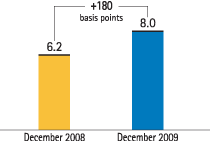

- Evolution of core capital

(Percentage) -

And maintain a cash dividend payment of 0.42 euros per share (a 30% payout on net attributable profit excluding one-offs)

- Total shareholder return

(Percentage) -

2009 2008-2009 2007-2009 2006-2009 BBVA +53.7% -8.1% -7.0% +0.2% Median for peers1 +29.2% -22.1% -21.8% -11.8%